What happened?

- CS news flows kept the investors awake at night and here comes to the end of the story: UBS takeover of CS

- What is keeping credit investors at night now is how CS AT1 bonds were wiped out as part of the forced marriage between UBS and CS. In early March, FINMA directed CS to write down its Additional Tier-1 (AT-1) bonds worth around $17bn to zero. This was done as part of the rescue deal under which UBS agreed to acquire the distressed investment bank

- While AT-1 bondholders will receive no recovery, its equity shareholders are receiving ~US$3bn worth of UBS shares as part of the deal. The decision to prioritize equity shareholders over AT-1 bondholders shocked the credit investors around the world

What is AT-1?

- AT-1 bonds are junior, unsecured and perpetual hybrid debt instruments issued by banks which may be “converted into equity or be written down upon the occurrence of certain trigger events”, including the bank’s capital ratio falling below certain threshold

- AT-1 bonds often offer more attractive coupons, as the instrument is taking cap structure risk as it is only senior to equity holders under liquidation waterfall

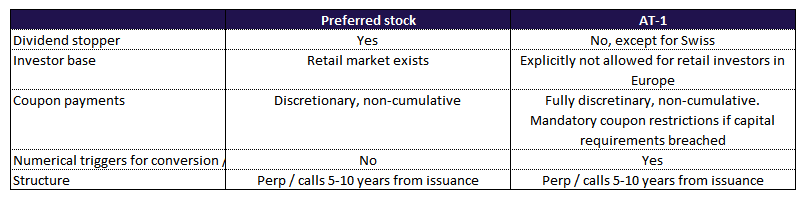

- These bonds were created after GFC to reduce the risk of taxpayer-funded bailouts of banks and shift the risk from the depositors to bondholders in absorbing losses. US banks do not issue AT1, but issue its specific hybrid Tier 1 capital called Preferred Shares. Key comparison is as follows:

- Some may argue that AT-1 bondholders were always notified of their wipe-out risks. However, the core issue here is that FINMA’s decision to wipe out AT-1, while saving equity holders overturns the well-accepted corporate finance principle that equity holders are below “creditors” in the capital structure. Credit investors argue that if AT-1 holders are to absorb the losses, equity holders should have taken the first loss

Any reference points?

- Prior to CS event, we have 2 examples where AT-1 bonds were wiped out.

- In 2017, Banco Popular in Spain tested AT-1 markets for the first time, as its entire AT-1 securities were entirely written down when it was acquired by Santander bank. However, in this case, equity holders were also completely wiped out too which was acceptable to investor community

- In other parts of the world, India is also witnessing an ongoing legal battle on the write-off of AT-1 bonds. Yes Bank, a private Indian bank, was restructured in 2020 and its AT-1 bonds worth of ~$1bn were written off as part of its restructuring plan which did not write off its equity capital

- AT-1 bondholders challenged the decision before Bombay High Court, which ruled in favour of the bondholders. The decision was based on the grounds that the administrators did not have the authority to wipe off AT-1 bonds

- The Reserve Bank of India and Yes Bank appealed against the Bombay High Court order and is currently pending before India’s Supreme Courts. The judgment is expected to be delivered in the next few weeks

- It would be interesting to follow the final results of Yes Bank case, as this could potentially affect the CS AT-1 holders’ strategy

- Another interesting observation is that after the write-down of CS AT-1 bonds were announced, regulators across the world have released statements affirming that AT-1 bondholders rank above equity shareholders. This indirectly challenges what the Swiss regulators have implemented. For example, EU supervisory authorities (ECB, EBA and SRB) issued that “common equity instruments are the first ones to absorb losses and only after their full use would Additional Tier 1 be required to be written down”.

- Singapore MAS issued a very interesting statement. It not only confirmed that equity holders will absorb losses before AT1 holders during the resolutions, but also such mantra will be applicable in “exceptional situations”

- Recall that CS was never put into resolution nor officially declared non-viable by regulators. It was the existence of extraordinary public support that triggered precautionary recapitalization leading to the write down of the AT-1 bonds

- Singapore MAS’ statement covers the point that AT-1 bonds’ hierarchy over equity will be respected even under exceptional situations, which include when the bank is not put into resolution but subject to precautionary recapitalization

What will happen to CS AT-1 bond holders?

- I believe most existing AT-1 bond holders have already sold their positions. The current holders are opportunistic buyers who were buying the dip to extract any settlements with FINMA / CS or UBS

- Pallas Partners LLP already announced on 21 Mar that it is building a group of holders of CS AT-1 bonds. The group will pursue a multi-faceted litigation strategy to seek to mitigate losses suffered by holders of AT1s through focused litigation against those who have acted to deprive the AT-1 bonds of their contractual rights

- Pallas and the investors will focus on the actions of FINMA to pass through last-minute legislation purportedly providing for this AT-1 wipe-outs which upended the established claims hierarchy allowing equity holders to remain the structure at the expense of AT1s

- CS AT-1 bonds are currently trading at ~5-6c. According to liquidation analysis based on public information, AT-1 bonds’ recovery values are ~30c, assuming waterfall distribution according to capital structure seniority

What is the implication to AT-1 markets going forward?

- AT-1 is $215bn market with ~60 issuers (HSBC, BACR and BNP having 10%, 8% and 7% market shares). After CS’ wipe out events, HSBC AT1 (~2.25bn) dropped from 93.5c to 85.5c in a single day. Reminder: HSBC is considered as one of the most stable banks with the largest balance sheet. DB’s AT1 dropped from 102.5c to 86c in a single day

- The pricings did recover to a certain extent (trading at early 90s), but the investors are now rethinking about the risk / reward. The cost of European banks refinancing / calling their AT1s is now more expensive. The next call is Unicredit on Jun-23 with US$1bn to call.

- Overhang around European financials will continue. While it may not lead to a systemic risk event, the long-term implications are important. The differentiation between banks will increase. Buyers of AT1 today only focus on buying high quality (HSBC, ING Group). Funding for the perceived weaker bank is a concern, yet may present attractive buying opportunities with good risk / reward.