Key Summary:

- Hinderburg published a negative report on Adani Group. Its key allegations are Adani Group’s involvement in breach of minimum shareholding law and financial frauds.

- Adani Group has rebuffed the claims by mostly pointing out Hinderburg’s lack of evidence in its claims, instead of explaining the issues raised by Hinderburg with clear evidence. This indirectly hints to investors that some of the allegations may be true.

- After the report, Adani Group lost US$90bn in equity values. However, in my opinion, this will not lead to collapse of Adani Group, as this would require full-scale investigations by the government. This is unlikely due to (i) the Group’s close relationship with Prime Minister Modi, (ii) the Group’s significant role in India economy / financial market and (iii) strong support from the conglomerates and local media.

- With distortions in the market, this presents buying opportunities for Adani Group, especially in bonds vis-à-vis equity, as equity valuations are above industry average. Bonds are currently trading at attractive price (~75c, implying 15-25% IRR YTM). If investors are confident that there will be support for Adani Group, this is an attractive entry point for Adani bonds.

What happened?

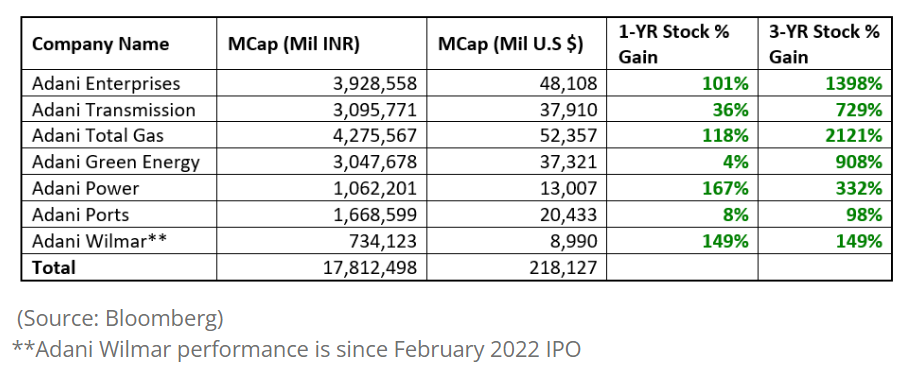

- Adani Group, founded by Gautam Adani, is one of the largest conglomerates in India and it once reached $280bn (INR24trn) market cap in Nov-22. The Group’s diverse businesses include port management, electric power generation and transmission, renewable energy, airport operations, natural gas, food processing and infrastructure.

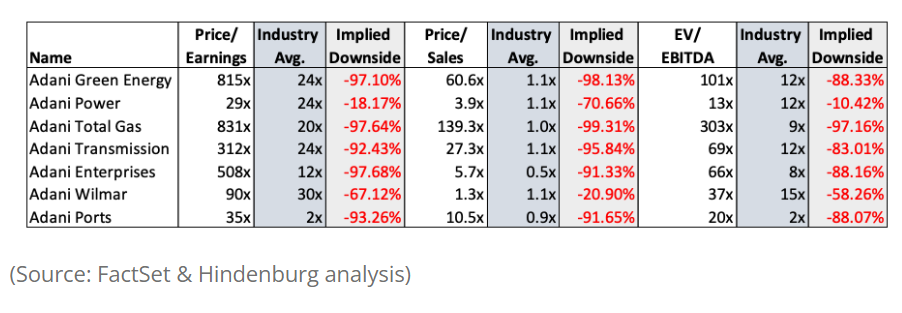

- Adani Group companies have seen their stock prices mysteriously surge over the past 3 years, defying the industry’s valuation norms.

- On 24 Jan, short-seller Hinderburg Research published a negative report on the Adani Group, which erased ~US$90bn market value in a few days.

What are the key allegations?

- Adani family has been using many offshore shell companies to hide family-controlled shareholdings.

- Hinderburg’s claims:

- Publicly listed companies in India are required to have at least 25% of the floating shares held by non-Promoters in order to mitigate manipulation and insider trading.

- Adani family uses offshore shells and funds to qualify as non-promoter “public” holders of Adani stock.

- For example, Adani Green Energy was in danger of delisting as its public shareholders only accounted for 13.5% of the total shares. To avoid delisting, Adani Green Energy completed two offerings of 11.58% shareholding to offshore entities controlled by Adani family in 2019.

- Currently, four of Adani’s listed companies are also on the brink of the delisting threshold due to high promoter ownership – Adani Enterprises, Adani Transmission, Adani Power and Adani Total Gas reporting more than 72% of their shares held by related parties. If the shares held by the opaque offshore shell companies were also recognized as Adani-controlled, the these companies are running the risk of delisting, losing access to public financing market.

- Adani’s claims:

- Adani Group issued a 413-page response to the Hindenburg report, refuting all allegations.

- On potential breach of min. threshold requirement, Adani’s comments are weak. Adani argued that Adani cannot address the allegations related to the offshore entities because it has no information on its public shareholders.

- Hinderburg’s claims:

- Another reason for the vast network of covert offshore entities is to round-trip funds to bolster the company’s balance sheet and its creditworthiness.

- Hinderburg’s claims:

- Two entities (Rehvar Infrastructure and Gardenia Trade and Investments) lent ~US$1bn to Adani Infrastructure, while they have no employees and operations. Rehvar’s two shareholders are current / former directors of Adani entities, while Gardenia’s director is the head of Adani private family office.

- Adani’s listed entities have paid US$770m to private contractor PMC Projects, which has no website and its address is same as Adani Group’s “dummy firm” according to Directorate of Revenue Intelligence.

- This highlights classic financial fraud where Adani family has been siphoning funds from the listed entities to private companies. The siphoned cash could be used (i) to lend funds to listed entities and (ii) purchase the listed entities’ shares, which strengthens Adani’s control over the listed entities and improve the apparent credit worthiness of the companies.

- Adani Eneterprises’ and Adani Total Gas’ audits present red flags as well, as they are audited by Shah Dhandharia, a small audit firm whose two partners (out of four) were only 23-24 years old when they started signing off on the Adani audits.

- Hinderburg’s claims:

What will happen as next step?

- Adani has been following a typical emerging markets playbook.

- Step 1: Categorically deny the allegations without providing any real evidence. Adani has been trying to turn public attention to the inadequacies of the report, rather than explaining why Adani is innocent. In Adani’s 413-page response, Adani argued that (i) Hinderburg’s claims were without evidence, (ii) most large Indian corporates operate under similar governance structures, (iii) Adani cannot address the allegations related to offshore entities because it has no information on its public shareholders and (iv) the group is entitled to protect itself from false and defamatory statements in accordance with the law.

- Step 2: Adani shores up its position by denigrating the Hinderburg for attacking the independence and local institutions of India.

- Step 3: Adani announced an independent review of accounts by a big-six audit firm to calm the international investors’ sentiments. Chances are that it will take long time for the report to be published. By the time the report is out, the market may have moved on.

- Key unknown is whether the Indian authorities will be compelled to relook at things, as opposition lawmakers have called for a wider probe into the affair.

- If SEBI (Securities and Exchange Board of India) launches full investigations and finds Adani’s breaches in min. threshold laws & fraud issues, this would imply delisting and loss of public financing access. This could trigger spill-over effect to Indian banking sectors, which have significant exposures to Adani Group.

- Indian banks have US$44.9bn secured loans to listed Adani companies. Adani family also has significant share-backed loans. Assuming 30% LTV, this would imply another $21bn exposure ($280 x 25% x 30%). In total, this would imply US$65.9bn exposure to Adani Group.

- As a context, top 11 Indian banks and finance companies’ book value is US$159bn. Of course, significant amounts within $65.9bn exposure includes international banks’ exposures. However, it is true that any credit event at Adani Group would stress Indian banking sectors.

- However, I don’t think there will be meaningful investigation on Adani Group for the following reasons.

- Gautam Adani is a confidante to Prime Minister Modi. After Hindenburg’s report, SEBI has not taken any active actions against Adani Group.

- Indian economy cannot afford to lose Adani Group, given its significance in its economy. Adani Group controls more than 60 infrastructures projects, ranging from Mumbai Airport to India’s biggest commercial port. India as a country cannot afford Adani to face credit events, as this would cause disruptions in the country’s key infrastructures’ operations.

- Adani Group is also supported by many conglomerates in India. Although not executed eventually, Adani could gather $2.5bn equity raising at Adani Enterprises with support from conglomerates including JSW Group and Bharti Enterprises. They would provide financial / political support to Adani Group. Many local newspapers have also been supporting Adani Group as they portray this situation as Western’s another attempt to colonize the country.

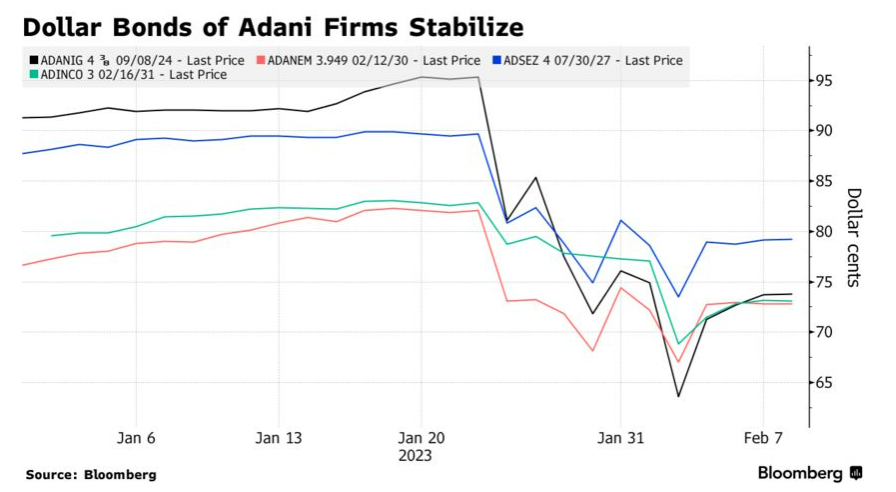

- Hence, this may present a buying opportunity for Adani Group’s bonds, whose prices have fallen to distressed levels. This is more attractive than Adani’s equities in term of risk rewards, as most of Adani Group’s equities’ valuations are being “normalized” through the recent crashes. Furthermore, as stock manipulation is still under investigations, it is possible that Adani Group’s equities may not reach the absurdly high valuations going forward.

- Adani bonds are currently trading at 75c level, implying 15-25% IRR opportunities for the bonds.

- These bonds are not likely to face credit events. Adani’s repayment schedules are mostly after 2024 (85% of total repayment schedules). By then, it is likely that the concerns around Adani Group might have been eased and Adani Group will continue to have banking supports.

- Most sellers of the bonds are mutual funds who are forced to sell the bonds due to their risk appetites at the technical levels (i.e. selling bonds if prices fall below 95c). Distressed funds (i.e. Oaktree, Davidson Kempner) have scooped up bonds in the last few weeks.